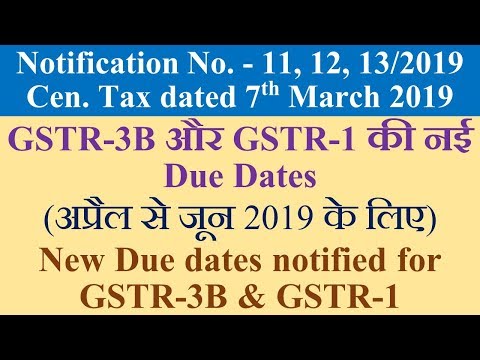

Hello friends, welcome to my YouTube channel. Today, I have a special notification for you. The notification number is 11 - Albert 1380. It's important to pay attention to this notification as it contains crucial information. This notification is related to a ticket for my daughter's birthday celebration. Unfortunately, there seems to be a mistake in the notification module. It mentions a cheetah licking, but it should actually be a licking. Additionally, Kusum Jingim, a worker, states that there is no notification in Upland monthly. Jesse Erwin, on the other hand, mentions quarterly GST at 1 or gesture 3 due dates. This could cause confusion, so please make sure to take note of the correct dates. Moving on, Escobar emphasizes the importance of empathy. BF Najafi Nancy highlights the significance of March 31st, 19 poo or Escobar for the juvenile Nancy layer. It seems that there are some errors in the text, but I will do my best to divide it into sentences and correct the mistakes. Firstly, there are notifications regarding the months of April, May, June, and Tino Monte inkay. These notifications are part of the key basic idea of the notification module. They notify you about the due dates. For example, Kehoe is notified via TK 2 key on March 31st, 2019. Saya Miyazaki, on the other hand, turns the entire system into an annual era tanka wala. This notification will most probably be sent on July 1st, 2019. So, if you apply yoga easily, the system will work smoothly in Pune. Now, let's focus on the attention-seeking notification. STR1 or gesture 30 plays a key role here. We need to skate dude red spoke in no TP. Kaczynski Jerry apologizes for that and clarifies the notification. You really need to be positive and know your TJ reaches. As I...

Award-winning PDF software

What is the extended due date for 990 Form: What You Should Know

So if you miss this deadline, you'll see extended due dates in your calendar year due date for tax-exempt organizations: May 3, 2018, June 19, 2019, Sept. 24, 2020, and May 1, 2021. This extension only applies to calendar year filers; you can still pay the tax on line 48 of your 2017/2018 tax returns. [See the section “How to File the Annual Tax Return as a Non-Business Entity” for details.] Form 990-PF Due Date : Form 990 and Forms 990-EZ for calendar year filers with no more than 500,000 in exempt income; 2025 due date is May 9. Jun 1, 2025 — Form 990 and forms 990-EZ for calendar year filers with more than 500,000 in exempt gross income; 2025 due date is Sept. 28. Sep 19, 2025 — Form 990 and forms 990-EZ for calendar year filers having exempt gross income of 500,000 or less; 2025 due date is Nov. 7. Dec 15, 2025 — Form 990 and forms 990-EZ for calendar year filers with more than 500,000 gross taxable income; 2025 due date is May 1, 2022. Apr 23, 2025 — Form 990 and forms 990-EZ for calendar year filers with taxable gross income of 500,000 10,000,000 or less; 2025 due date is Oct. 27. June 2, 2025 — Form 990 and forms 990-EZ for calendar year filers having gross taxable income of 500,000 or less; 2025 due date is April 22, 2025. Dec 31, 2025 — Form 990 and forms 990-EZ for calendar year filers with more than 500,000 gross taxable income and less than 2,500,000 net capital loss carrybacks. Jan 31, 2025 — Form 990 and forms 990-EZ for calendar year filers having gross taxable income of 2,500,000 and less than 25,000,000; 2025 due date is July 16. May 15, 2025 — Form 990 and forms 990-EZ for calendar year filers having taxable gross income of more than 25,000,000; 2025 due date is Oct. 16.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8868, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8868 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8868 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8868 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is the extended due date for form 990