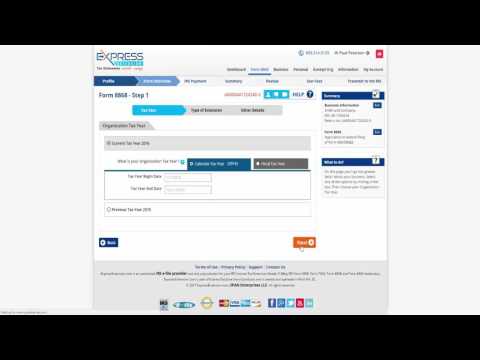

Welcome to ExpressExtension.com. We're applying for an extension with the IRS. It is easy to file for an extension if you need more time to file your exempt organization income tax return. Don't worry, ExpressExtension.com has exactly what you need - Form 8868. With ExpressExtension, you can e-file Form 8868 quickly and easily within minutes. The IRS is now combining the three-month automatic and non-automatic extensions into a single six-month automatic extension form for the current 2016 tax year. You can file Form 8868 with ExpressExtension.com. The entire process is really simple and there are helpful prompts to guide you from start to finish. Begin by logging in and clicking "Create Exempt Organization Income Tax Extension." Then, select your organization from the drop-down menu from previous entries or click "Add New Organization" to enter your personal information and exempt organization details. Make sure the information matches what the IRS has on record. Next, provide more detailed financial information about your business. Select one of the options by clicking on it, and then choose the option to extend your forms for an automatic six-month period based on your organization. ExpressExtension will then provide a summary of your business and check all the details for accuracy before proceeding. After completing these steps, ExpressExtension will conduct a review to ensure there are no errors on your extension. If any errors are found, click the back button to edit your details. If no errors are found, simply review your order summary before submitting it to the IRS. Once your extension is successfully transmitted, you can track the status of your extension on your dashboard. Take advantage of our easy process today and see how simple it can be to get more time to file. If you have any questions about ExpressExtensions, contact our customer...

Award-winning PDF software

8868 instructions 2025 Form: What You Should Know

Form 990) — with a refund. The return must be filed within 6 months of due date (7-days) as a part of the “Extensions for Return Preparation” process. Form 990-N — Electronic Notice When Form 990-N is due, you must file Form 990-N by the time fixed for filing Form 8868. The due date of Form 990-N is the due date of Form 8868. See the instructions for Form 8868. Form 990-N and Extensions for Return Preparation, see instructions. Aug 26, 2025 — More In Forms and Instructions IRS Form 990-EZ and Extension of Time To File. IRS Form 990-EZ (Extension of Time to File), you may use to request an extension of time to file your return when the due date of Form 990-N is on or after the 15th day of that month. Form 8868 — Request for Additional Time To File. IRS Form 8868 (Request for Additional Time to File), you may use to request an extension of time to file your return when the due date of Form 990-N is on or after the 15th day of that month. IRS Form 8868, “Request for Additional Time to File,” is for situations where the required due date of Form 990-N is on or after the 15th day of the following month. Form 8990, “Application for Extension of Time To File,” is the same as Form 8868, except it does not provide an extension of time to file. Form 8868 — Request for Additional Time to File. Form 8868 — Request for Additional Time to File, is for situations where the required due date of Form 990-N is on or after the 15th day of the following month. Forms 990-TN and 990-TF are the same as Form 8868. Form 8990 — Application for Extension of Time to File Form 8990 — Application for Extension of Time to File, to get your Form 990 to file.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8868, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8868 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8868 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8868 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8868 Instructions 2025